Ethics & Integrity

Regeneron is valued and trusted for the innovative medicines we provide. Maintaining that trust requires our collective commitment to conducting business ethically, legally and in adherence to the high standards we set for ourselves.

Our compliance program

A strong culture of integrity is foundational to our compliance program. Our philosophy is simple: Compliance is owned by everyone, championed by leaders and fostered by our compliance team.

Policies and procedures

Regeneron maintains written policies governing a wide variety of legal, regulatory and policy matters. All such policies are made available to employees on the corporate intranet.

Compliance governance

Working alongside Regeneron’s Chief Compliance Officer (CCO), our Compliance Committee is made up of senior leaders representing all the major functions in the company and meets at least quarterly to oversee the Compliance Program. The Corporate Compliance team owns and operates Regeneron’s compliance program and oversees compliance matters across the enterprise. Our CCO directs our program, reinforces our culture of ethics and integrity and provides regular updates to the Board’s Corporate Governance and Compliance Committee.

Training and education

Training resources include live training and online compliance education, as well as online access to policies. There are also new-hire and annual online training programs that support compliance education.

Culture of integrity

Critical to the success of any compliance program is maintaining and fostering an environment where employees and others feel comfortable asking questions, raising concerns or offering ideas, without fear of retaliation.

Regeneron maintains an anonymous and confidential 24-hour hotline that provides individuals, whether employed by Regeneron or not, the means to raise concerns over any Regeneron activity that may be inconsistent with any law, regulation, company policy or our Code of Business Conduct and Ethics.

In addition to the confidential hotline, individuals may also make an anonymous report to our compliance website www.regeneron.ethicspoint.com.

Monitoring

Effective monitoring and auditing aids in the detection and prevention of non-compliance. Regeneron has a dedicated team that conducts a variety of monitoring activities in an effort to ensure compliance with laws, regulations and policy.

Enforcement of standards

Regeneron's Code of Business Conduct and Ethics includes a reference of disciplinary standards, including the potential for termination as a result of non-compliance. Regeneron publishes its policies on progressive discipline and other disciplinary matters on its corporate intranet site.

Corrective actions

Any reports of suspected non-compliance that are raised to the attention of the Compliance Department are promptly investigated. Any corrective action will take place in a timely fashion and where necessary, matters shall be reported to relevant governmental authorities.

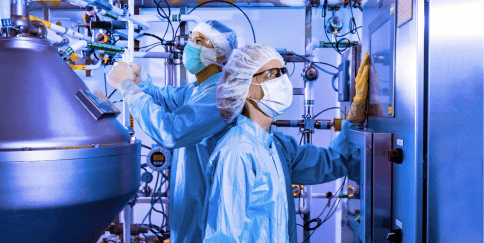

Our Responsible Business

The safety of our patients is our top priority and critical to delivering on our mission. Regeneron’s award-winning Industrial Operations and Product Supply (IOPS) organization has systems and training in place to ensure delivery of innovative and safe products. We comply with quality principles in our operations, manufacturing and distribution.

We collect product technical complaints and adverse events related to our medications so that we can monitor their safe use throughout the product lifecycle. We are committed to our responsibility for timely reporting of safety information to the U.S. FDA and other regulatory authorities, in compliance with regulations and global expectations. In order to ensure full transparency of our expectations, we provide annual training on adverse event reporting for employees, contractors and suppliers.

Patients are best served when they and their physicians are given consistent, accurate and balanced information about our medicines. Laws, regulations and industry standards govern the advertising and promotion of our products. Our policies provide clear requirements for promotional materials and communications to employees, contingent workforce and vendors who communicate with the healthcare community. Customer-facing colleagues receive annual and extensive training regarding regulations and our policies.

Regeneron is a member of the Biotechnology Innovation Organization (BIO). We endorse BIO’s principles on the responsible sharing of truthful and non-misleading information about medicines with healthcare professionals and payers. We support data transparency that advances science and medicine, protects participant privacy and is in the best interest of individuals who use our products and providers who prescribe them. We are committed to sharing data from our clinical research and clinical trials in a responsible manner. View our Clinical Trial Disclosure and Data Transparency Statement.

We are committed to and abide by all ethical requirements related to animal welfare in research, teaching and testing. All research involving the use of live animals must be approved by the Regeneron Institutional Animal Care and Use Committee (IACUC), a requirement of U.S. federal and state laws. The IACUC has a key oversight role, including the review and approval of animal use activities and inspection of animal facilities. In addition, we comply with the Three Rs (Replacement, Reduction and Refinement), widely accepted ethical principles that are now embedded in the conduct of animal-based science in many countries around the world. Colleagues engaged in research involving laboratory animals receive annual training in the proper care and use of these animals. Regeneron has earned accreditation from AAALAC International, a nonprofit that assesses organizations that use animals in research, teaching or testing.

We meet or exceed all Environmental, Health, Safety (EHS) and Security regulations. We have an extensive range of programs, plans and procedures to ensure the safety of all people who come to work at Regeneron. These include:

- Hazard recognition and communication

- Risk evaluation and control elements

- Workplace design and engineering

- Regulatory compliance

- Emergency preparedness and business resiliency

- Auditing

- Employee training, education and engagement

We adhere to the standards set by local occupational health and safety regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) and the Ireland Health and Safety Authority. We undertake routine site inspections and manage our leading EHS indicators to help reduce the risk of workplace accidents. We actively encourage colleagues to report potential hazards as a preventative measure.

We engage an independent assurance provider to conduct independent verification of select EHS data. View our latest External Assurance Report.

Delivering medicines to patients in a timely fashion relies on our ability to source the goods and services we need, while meeting specified standards in a sustainable, ethical and cost-effective way.

Supplier Governance and Compliance

We hold our suppliers, contract manufacturers and business collaborators to the same high ethical and labor standards to which we hold ourselves. This is reflected in our Vendor Code, which includes standards on ethics and human rights. We are also committed to continuing to provide effective training and education to our employees on all compliance matters, including training for our supply chain professionals regarding human trafficking and slavery.

Our medicines are manufactured to the highest standards of quality, and we ensure that our supply chain maintains the same level of quality. Suppliers are routinely subject to quality audits, including written audits and on-site inspections. These audits, in concert with personal engagement of management and in-person meetings during routine business operations, would allow us to identify any violations of law or conflicts with our Compliance Program. Any supplier found to use forced labor or human trafficking would be terminated from the Regeneron supply chain.

Suppliers and the Environment

Scope 3 greenhouse gas emissions occur beyond a company’s operations and are complex to measure and manage. Supplier engagement and capacity building are critical to enhance the accuracy of our value chain emissions inventory and, ultimately, to reduce emissions. We are members of the CDP Supply Chain program, which help us to engage our suppliers to collect Scope 3 emissions data. This initiative is part of our broader effort to identify emissions reduction opportunities and advance our environmental sustainability.

Sustainable materials selection is important to our business. We actively support suppliers that offer safe, environmentally responsible products. At our facilities, these can range from low-emissions carpet and low-volatile organic compound paint to green cleaning products, environmentally friendly lab supplies and compostable tableware. If materials are not compostable, we try to select alternatives with recycled content.

Our patients, colleagues, partners and other stakeholders trust Regeneron to protect the privacy of their personal data and we treat this responsibility with the utmost seriousness. This is especially important at a company on the cutting edge of science and technology because our business and the privacy landscape are dynamic. We have established Regeneron’s data privacy philosophy to guide our people and our approach to scientific exploration and the development of our processes, medicines and services.